The untapped Muslim beauty market: From Modest Fashion to Halal Cosmetics

Imagine a group of more than one billion consumers who are not your conventional buyer but still they have a strong interest to purchase goods that suit a particular lifestyle.

The Muslim population occupies such a segment and is definitely one that has begun to be taken into consideration. In search of new markets, the fashion designers and the beauty sector has begun to expand beyond the mainstream markets and trends.

Muslims comprise over 23% of the global population, according to a Pew Research Center estimate. As the Muslim population grows, more and more people are searching for halal alternatives to common cosmetics and personal hygiene products.

The global Muslim population has diverse tastes and interests but it also comes with several religious requirements that limit their purchases.

Islam is meant to be a way of life, not just a series of practices and traditions, so the governing rules permeate many of a Muslim’s daily choices, including clothing and cosmetics. While there is a certain flexibility in how strictly to adhere to these rules, many Muslims ensure that what

they buy is halal (which mean permissible) and not harm (or forbidden), according to their faith.

The principles of Islamic law are behind the purchasing decisions of-of many Muslims but their requirements are not alway met in the global marketplace.

The global Islamic market is projected to reach $488 billion by 2019

Muslim fashion is driven by an underlying Islamic mandate to preserve modesty, as laid forth in the Quran and the Sunnah (way) of the Prophet (peace be upon him). In addition to being commanded to adhere to modesty, Muslims are also encouraged to wear good quality clothing so as to celebrate the blessings bestowed upon them by God.

Muslim consumers tend to focus more on modest fashion and accessories lines but that does not mean they do not spend good money to support their lifestyle and taste.

A report by Euromonitor estimates that Muslims will make up more than a quarter of the world’s population by 2030. Moreover, the global Islamic market was worth over $3.6 trillion in 2013, and the market is projected to be worth over $5 trillion by 2020. Under these circumstances,

Muslims around the world are waiting for more diversity and suppliers ta catch up with demand for Muslim-friendly products. Demographics also play a role in this burgeoning market. While the average age of citizens is around 30 in majority-Muslim countries, Europe and the US has

an average population age of 44. Because the purchasing power of young consumers should grow over time, the market for Muslim goods is expected to thrive in the next years.

In search of mainstream markets, Muslim textile designers are pushing the boundaries of Sharia compliance. Hijab fashion leads the Muslim fashion purchases which then includes other categories such as clothes (tops, bottoms and dresses) and accessories.

There is no universal wardrobe for a Muslim woman. Muslim women wear colourful salwaar kameez in India, abayas in Dubai, long shirts and coats in Turkey, and Western clothing in South Africa, the US, and the UK with modifications for modesty.

As more and more Muslim women actively participate in sports, there is a growing need for hijab-friendly sportswear and swimming attire.

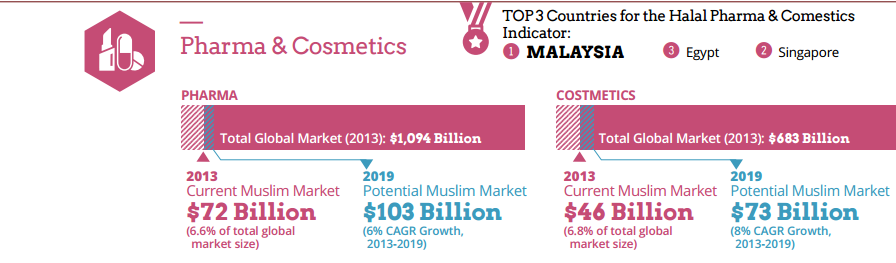

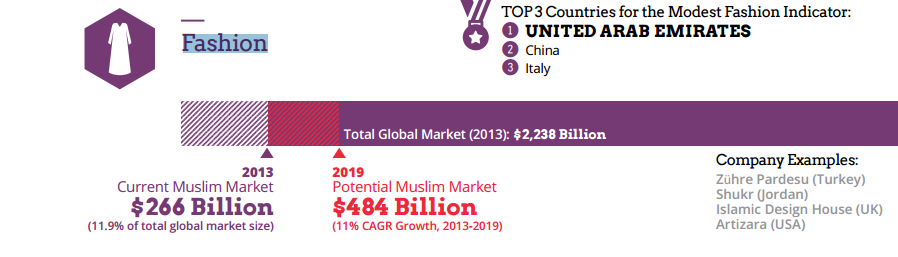

A Thomson Reuters report found that around $266 billion was spent on clothing and footwear by Muslim consumers in 2013. This makes the Muslim clothing market to be 11.9% of the global expenditure and is expected to reach $488 billion by 2019.

The market for Muslim fashion is also projected to account for over 14% of the global fashion market by 2019.

Top countries with Muslim consumers clothing consumption (based on 2013 data) are Turkey ($39.3 billion), United Arab Emirates ($22.5 billion), Indonesia ($18.8 billion), and Iran ($17.1 billion). Among these countries, UAE stands out as a high consumer clothing expenditure country with a relatively small population.

Meanwhile, UAE, China and Italy lead the Modest Fashion Indicator that focusses on the health of the modest fashion ecosystem a country has relative to its size.

While the market for e-commerce in this sector is still relatively small, it is also growing faster than conventional fashion sales online. More specifically, it expanded a rate of 25.4% in 2013, as compared to 5.8% growth in conventional fashion-related e-commerce.

Given the importance of digital platforms to the fashion industry, a special Muslim Fashion E-Commerce focus report estimates Muslim consumers’ e-commerce expenditure at $4.8 billion in 2013. The largest Muslim clothing e-commerce markets as of 2013 are Turkey ($474 million), USA ($442 mill), UAE ($428 mill), Saudi Arabia ($366 mill), Germany ($291 mill), UK ($239 mill), France ($211 mill), Iran ($191 mill), Egypt ($164 mill) and Morocco ($133 mill).

USA ($442 mill), UAE ($428 mill), Saudi Arabia ($366 mill), Germany ($291 mill), UK ($239 mill), France ($211 mill), Iran ($191 mill), Egypt ($164 mill) and Morocco ($133 mill).

These figures reflect the current internet and e-commerce influence of the Muslim market.

Driven by the tremendous interest in modest clothing, Islamic fashion shows are proliferating all over the globe. In South East Asia, for example, Indonesia Islamic Fashion Fair and Malaysia’s Islamic Fashion Festival are held on a national scale every year.

Important high street brands such as Tommy Hilfiger and Mango have both launched Ramadan collections for Middle Eastern clientele.

While, Dolce & Gabbana has launched an abaya and hijab line, and in countries like Dubai, the range of expensive abayas is astonishing; flowing designs, Swarovski-embellished, and produced in an assortment of fabrics.

Halal cosmetics market expected to reach $73 billion by 2019

There is also the potential for growth in the cosmetics industry, where two important sectors food and fashion collide.

Halal beauty refers to products manufactured, produced, and composed of ingredients that are halal (or “permissible”) under Islamic law. This means that each product should not contain any pork or animal that were dead prior to slaughtering, blood, alcohol or carnivorous animals.

Many Muslims believe that products applied topically on the skin should adhere to halal standards.

As women unintentionally consume some of their lipstick over the course of the day, it must be halal because some lipsticks contain animal fat. Some Muslims stick to beauty producers who go vegan, but again, that really limits the range of beauty products.

Muslims spend an estimated $46 billion on cosmetics in 2013 which is 6.8% of global expenditure and also saw sluggish growth of 1% only from the year before. This spending is 6.78% of the global sector expenditure and is expected to reach $73 billion by 2019. Market research firm

TechNavio also sees halal personal care products’ sales growing 14 percent per year until 2019.

Halal cosmetics were estimated to make up 11 percent of a global halal market worth more than $1 trillion in 2015, according to Deloitte Tohmatsu Consulting.

Top countries with Muslim cosmetics consumers are United Arab Emirates ($4.9 billion), Turkey ($4.4 billion), India ($3.5 billion), and Russia ($3.4 billion) based on 2013 estimates.

Major cosmetics brands like Shiseido and Estée Lauder are taking note of the increasing demand coming from Muslim customers, and both companies have acquired halal certification for certain products sold abroad. While, Unilever, Beiersdorf and L’Oreal are among the

multinationals converting their beauty products according to Halal certification.

Halal certification is official recognition that a product does not contain traces of pork, alcohol or blood, and must be made on factory lines free of contamination risk, including from cleaning.

While the market for Muslim-friendly products has been developing over the years, there is still a lot of room for growth as the Muslim consumer base continues to increase.