What are the biggest financial regrets for Americans

Only one-fifth of American adults say they have no financial regrets while the rest 73% say that if they could turn back in time, they would do things differently, economy-wise. The findings were reported by the most recent Bankrate survey which also underlines what is the biggest financial regret for American’s.

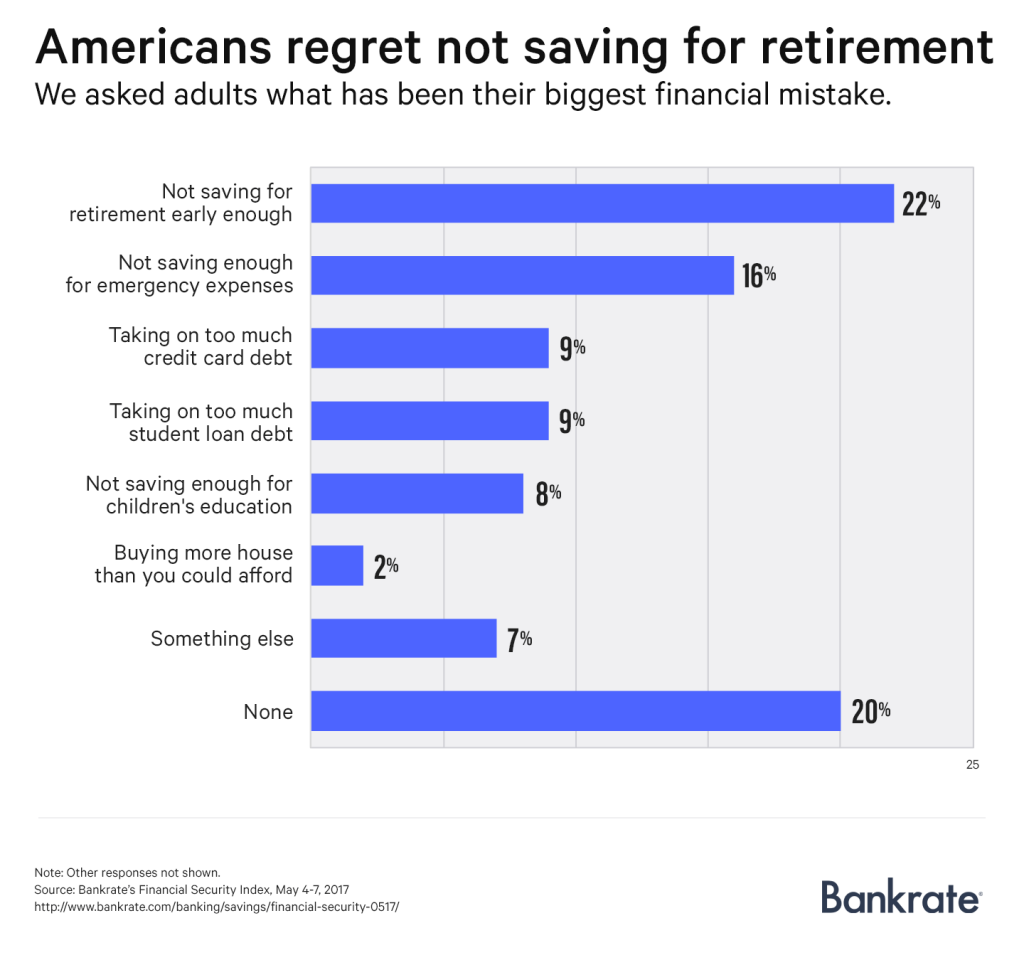

American adults seem to be most preoccupied about the fact that they did not save enough money, either for retirement or for emergency expenses. 22 per cent of those questioned said their biggest regret was not putting money aside for retirement while 16 per cent admitted that they are uneasy about not saving money to deal with unpredictable spending.

And the guilt over not putting aside money for rainy days seems to be growing since 22 per cent say that’s their worst financial blunder, up from 18 per cent last May.

“The burden of saving for retirement has shifted in recent years from employers to individuals. As a result, many Americans have either been unable or unwilling to save sufficiently for retirement,” says Mark Hamrick, Bankrate’s senior economic analyst and Washington bureau chief. “As with any savings effort, planning for retirement can be viewed under the banner of paying yourself first. If you are a full-time employee, try to take advantage to the fullest extent possible participation in a 401(k) plan.”

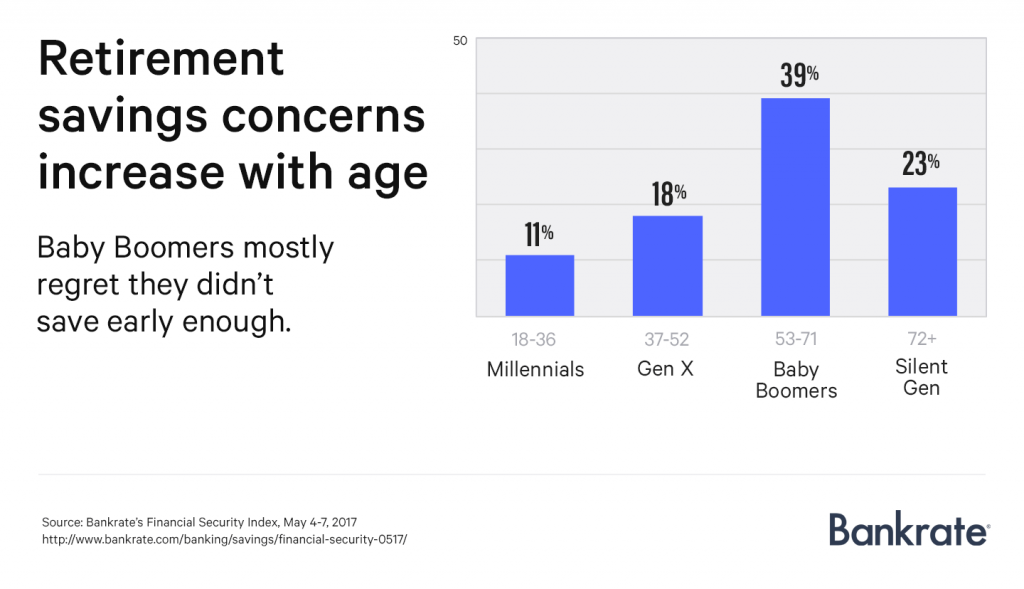

Regrets about not saving enough for old age seems to be common among all generations and all genders, the report suggests but is more common among older adults. 37 per cent of adults ages 50 to 64 say not saving for retirement early enough is their biggest financial regret and 26 per cent of those over 64 agree.

Among those with second thoughts about their financial decisions, it’s also the biggest concern for people in each of the income brackets above $30,000 annually that Bankrate surveyed.

While Baby Boomers make up the largest proportion of those concerned over retirement funds, the burden seems to weigh on the next generations as well. Eighteen per cent of Generation X and 11 per cent of Millennials say that their biggest mistake is not putting away money for retirement.

American adults also regret, in the case of 9 per cent of those questioned, taking on too much credit card debt while the same percentage voiced concerns about taking on too much student debt.

Some 8 per cent said that they regretted not saving money to pay for the children’s education.

Other adults have splurged when it comes to housing and 2 per cent admitted that they feel guilty about buying a home that exceeded their financial capabilities.

But the Bankrate study also had some good news as a quarter of Americans said that they are on the right track for putting money aside and, for the first time since last June, women seem to feel more comfortable with their savings than men. Twenty-one per cent of women and 24 percent of men report feeling less comfortable with the amount of money they’ve saved today versus 12 months ago.

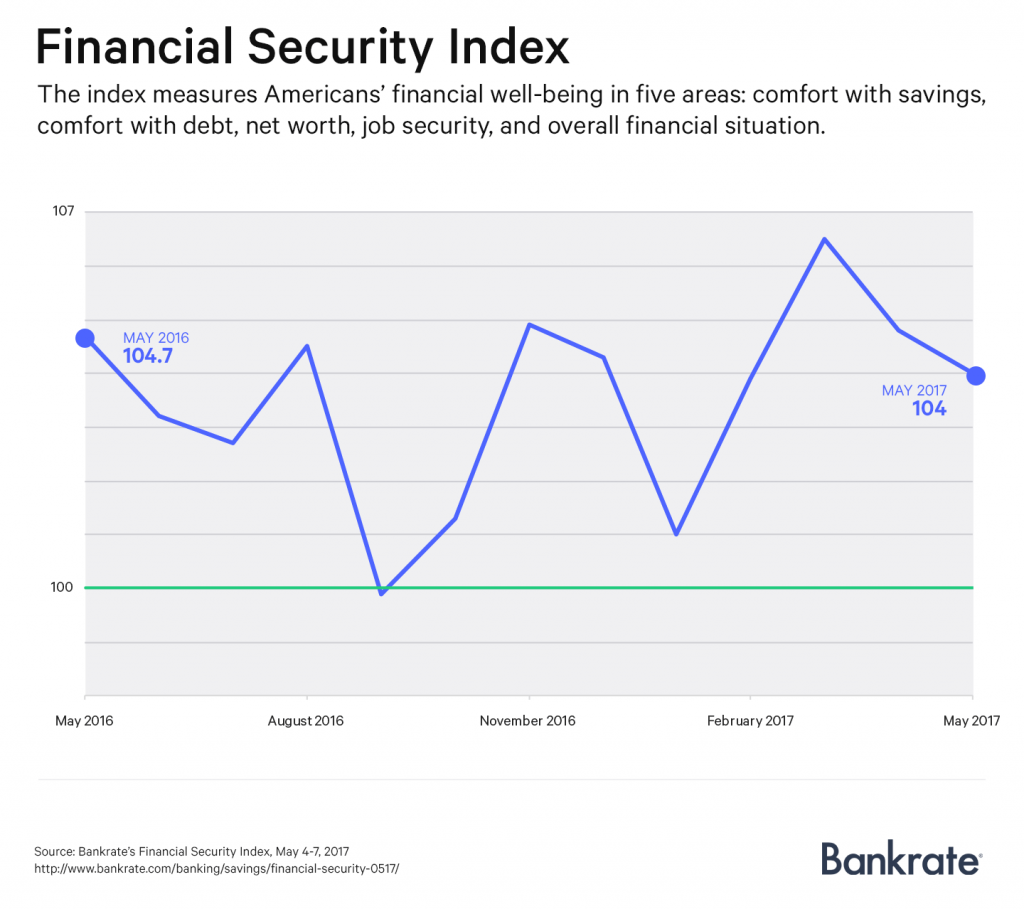

When looking at all the financial issues combined, Bankrate reports that its Financial Security Index has dropped, for the second straight month in May. But compared with last year’s data, the readings on all measures of financial security showed improvement.

The index measures American’s financial well-being in five areas: comfort with savings, comfort with debt, net worth, job security and overall financial situation.