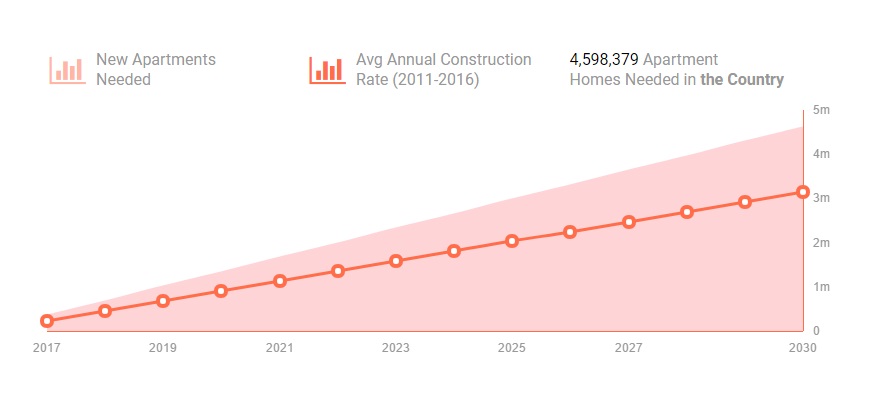

4.6 million apartments must be built in the U.S. until 2030 to meet rising demand

The United States need 4.6 million new apartments by 2030, far more than the current pace of construction, according to a recent study. Also, more than 11 million units date before 1980 and may need significant repairs.

The analysis of the US real estate market, conducted by Hoyt Advisory Services and commissioned by the National Multifamily Housing Council (NMHC) and National Apartment Association (NAA), two nonprofit industry groups, reveals that the country needs 328,000 new apartment every year to meet demand, while the industry averaged just 225,000 completions from 2011 to 2016.

“Single-family rentals have helped to satisfy some of the rental unit demand but we do not expect that market share to continue to increase. Based on 43% of the total rental demand being

satisfied with traditional 5+ multifamily units, we will need an average of 328,000 units per year from now through 2030 and cumulatively 4.6 million units of 5+ unit housing. New supply will also need to match requirements for all income levels, not just the top tier of the market. Anything short of this will simply drive up rents faster, far exceeding expected household income growth and requiring more doubling up and house sharing,” according to the study.

The figures regarding the higher demand on the real estate market are supported by the forecasts on population growth, whose evolution is expected to slow from a 0.9% raise per year on average from 2000 to 2010 to 0.7% on average from 2016 through 2030.

At the end of 2016, the country’s population was approximately 325 million people, growing at approximately 2,229,000 per year. “Net immigration is the least predictable but most important for forecasting future population. The reason is that as the U.S. population continues to age our domestic death rates will slowly approach our birth rates. We will continue to add net population at the rate of about 1.35 million for 2017 (births

“Net immigration is the least predictable but most important for forecasting future population. The reason is that as the U.S. population continues to age our domestic death rates will slowly approach our birth rates. We will continue to add net population at the rate of about 1.35 million for 2017 (births less deaths) but the net immigration figure for 2017 will run 0.88 million. By 2023 and beyond the rate of expected population growth from net migration exceeds that of births less deaths. By 2030, net immigration is expected to run 1.33 million compared to an internal net population increase of 840 thousand,” the study anticipates.

Without immigration, population growth is estimated to decrease to 0.4% per year through 2030, less than half the pace registered in the past decade. Even under these circumstances, the US will still need more houses to supply the demand, given that, by 2030, the country is expected to have approximately 141 million households. “From the end of 2016 through the end of 2030, the population should grow in total by 9.8% but the household growth rate over

“From the end of 2016 through the end of 2030 the population should grow in total by 9.8% but the household growth rate over than same period is 12.8%, as the household size declines. This is an annual compounded growth rate, in our base case, of 0.7% in population increase and 0.9% in household increases,” the authors of the study revealed.

In-migration policies and trends are among the major drivers of metro and state level household growth. “As a whole, the U.S. depends on immigration to fuel the labor market. Any declines in immigration rates will severely curtail both the growth of the U.S. economy and future housing demand,” the study points out.

“Among the metro markets studied, migration rates are a key telltale sign of the local economy’s direction. Those metros with strong economies also have significant population growth rates often derived from in-migration from both domestic and international sources. Examples include Houston, Charlotte, Austin and Tampa-St. Petersburg. Markets such as Washington D.C. and San

Diego have strong international in-migration but experience domestic out-migration”.

According to the same source, in recent years, several metropolitan areas, such as Chicago, Detroit, Milwaukee, Philadelphia, St. Louis and New York would have had zero or negative population growth if it had not been the international or the in-migration. “Their natural population increases have been more than offset by domestic out migration and yet international migration has significantly supplemented the population”.

Areas with the highest demand on the real estate market

Although the need for additional units impacts cities across the country, the demand is expected to be very high in the Western U.S., as well as Texas, Florida and North Carolina. Fast-growing cities such as Raleigh, North Carolina (over 69% increase forecast), Orlando (almost 57%), and Austin, (almost 49%) are expected to have the greatest need for new apartments. Also, large urban areas need a considerable increase of new units, including the New York City metro area (almost 279,000 additional apartments), Dallas-Ft. Worth, Texas (266,000 new units), and Houston, Texas (214,000 new households).

According to the study, by 2030, more than 100,000 new rental units will be needed in states such as California, Georgia, Arizona, Florida, North Carolina, New York, Texas and Washington. “The fastest economic and household growth will continue in low-cost, business friendly states, primarily in the southeast and mountain west”.

“The Southern states driven by economic growth, low costs and diversified demographic growth continue to lead demand forecasts with metropolitan markets in Texas and Florida ranked in 5 of the top 6 places. Phoenix, Atlanta, Raleigh and Las Vegas also rank in the top 10. Slower growth markets are more likely to experience new demand growth in specific neighborhoods. Developers and investors should evaluate these markets carefully for new growth as well as revitalization of existing neighborhoods. These markets are frequently located in the Midwest and Old South and include markets such as Cleveland, Milwaukee, Birmingham, Pittsburgh and New Orleans,” the study reports.

On the other hand, the study reveals that some markets could surprise on the upside. “For example, large tech campuses continue to expand in Seattle. A growing hub of large tech firms could attract more than expected small tech firms as well as individuals looking to escape the high costs of Silicon Valley. Detroit is at the other end of the growth spectrum but has been increasingly attracting a few investors who are aggregating large tracts of land”.

High demand for repairs

With 11.7 million units built before 1980 in the US, although it’s unknown how many of these properties have already been improved or renovated, it is created a significant market size for repairs. More than 65% of the multifamily housing stock in properties with five or more units was built before 1980 in the northern states and California, while in the southern markets less than 35% apartments are in older buildings.

“Less than 35% of the rental stock was built after 1980 in much of the Northeast indicating significant need for rehabilitation of existing stock. These markets have also tended to be less volatile over the past 20 years”.

Two recessions, to hit the US by 2030

The forecast also assumes that, given the maturity of the current economic cycle, the US economy could go through two recessions by 2030. “Even under this scenario, all 50 states and the 50 metropolitan markets in this study will need new multifamily housing going forward to meet a growing population base,” the study points out.

“While the timing and severity of economic recessions are difficult to predict, the U.S. has experienced a recession every four to ten years during the past fifty years. Thus, we broadly estimate two recessions slowing down household formation rates in the forecast horizon, the first estimated around 2019 lingering until 2020 and the second and larger recession in 2030, possibly starting in 2029 and lingering through 2031. The first recession is forecast to be mild and is based upon the normal economic cycle. A second mild recession could occur in 2026 but will depend more on a global economy and is not factored into any of our models. The third recession is estimated to be quite severe and is based upon entitlements (Social Security and Medicare) running out of funding resulting in the need for massive tax increases and some budget cuts,” the authors say.

The recessions will also affect the growth rate of the household exceeds that of the overall population. “The number of households actually shrinks slightly in 2030 as more people double or triple up during a significant recession.”